The Total Guide to Order Cryptocurrencies in 2024: Tips and Best Practices

The Total Guide to Order Cryptocurrencies in 2024: Tips and Best Practices

Blog Article

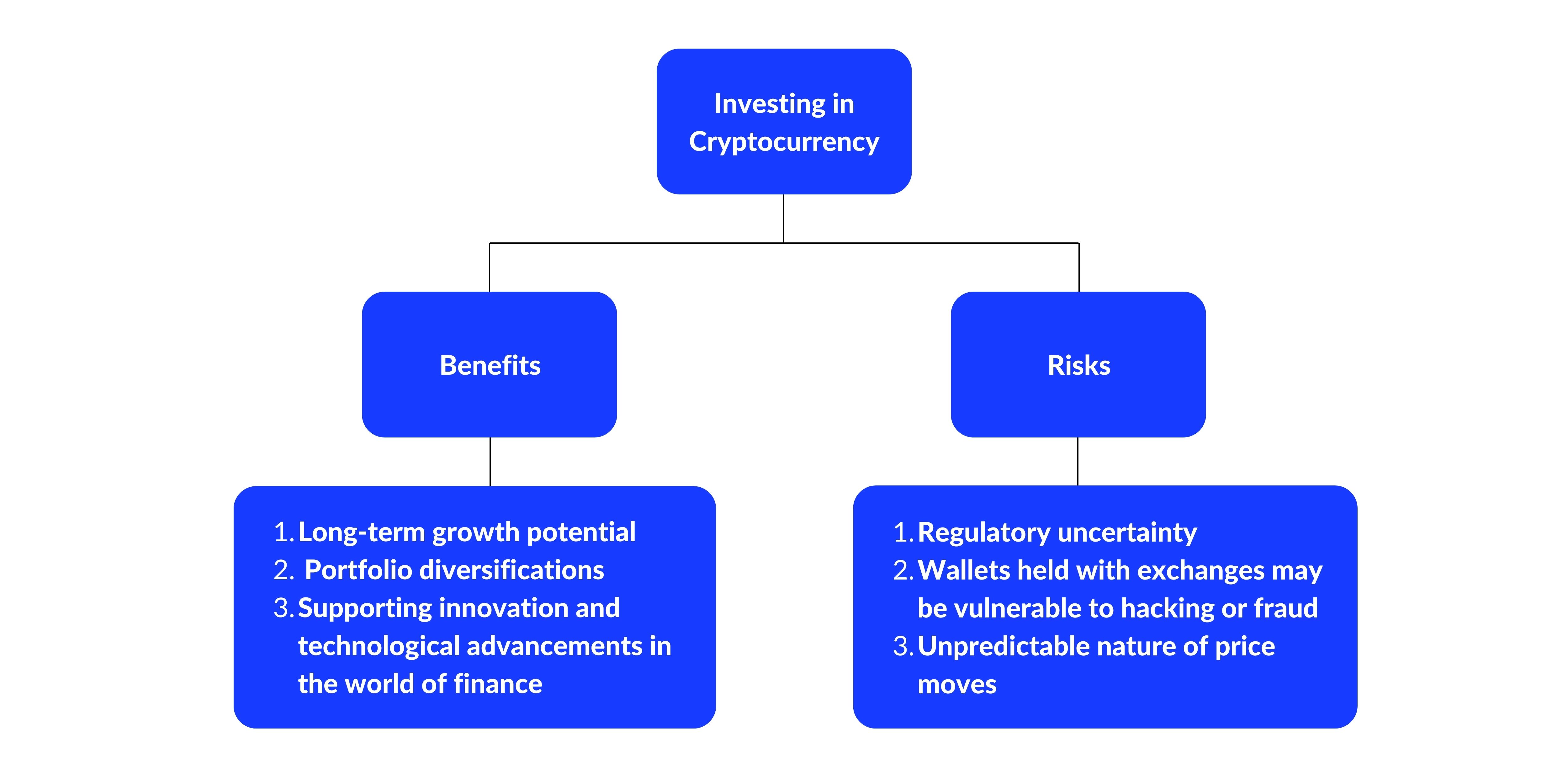

Exploring the Perks and Dangers of Purchasing Cryptocurrencies

The landscape of copyright investment is identified by an intricate interplay of compelling benefits and substantial dangers. While the allure of high returns and portfolio diversification is attracting, possible financiers have to browse inherent difficulties such as market volatility and governing uncertainties. Understanding these characteristics is important for anybody thinking about entrance into this volatile arena. As we additionally take a look at the subtleties of copyright financial investment, it comes to be apparent that informed decision-making is extremely important; nonetheless, the question remains: How can capitalists effectively stabilize these benefits and dangers to protect their financial futures?

Understanding copyright Essentials

As the digital landscape advances, understanding the basics of copyright comes to be vital for prospective financiers. copyright is a type of electronic or virtual currency that uses cryptography for safety, making it challenging to fake or double-spend. The decentralized nature of cryptocurrencies, generally improved blockchain innovation, boosts their security and openness, as deals are videotaped throughout a dispersed journal.

Bitcoin, produced in 2009, is the initial and most well-known copyright, yet thousands of choices, called altcoins, have actually arised ever since, each with unique attributes and purposes. Capitalists ought to familiarize themselves with vital ideas, consisting of wallets, which save exclusive and public secrets needed for purchases, and exchanges, where cryptocurrencies can be bought, sold, or traded.

In addition, understanding the volatility related to copyright markets is important, as costs can change significantly within short periods. Governing considerations additionally play a considerable duty, as various countries have varying stances on copyright, affecting its use and acceptance. By grasping these foundational components, potential capitalists can make informed choices as they navigate the complex world of cryptocurrencies.

Trick Advantages of copyright Investment

Buying cryptocurrencies uses a number of compelling benefits that can attract both beginner and skilled financiers alike. One of the primary advantages is the capacity for substantial returns. Historically, cryptocurrencies have exhibited amazing price admiration, with very early adopters of properties like Bitcoin and Ethereum understanding considerable gains.

An additional trick benefit is the diversity possibility that cryptocurrencies provide. As a non-correlated property course, cryptocurrencies can act as a bush against standard market volatility, permitting financiers to spread their risks throughout different financial investment vehicles. This diversity can boost general portfolio efficiency.

Additionally, the decentralized nature of cryptocurrencies uses a degree of autonomy and control over one's possessions that is usually lacking in conventional financing. Investors can manage their holdings without middlemans, potentially decreasing costs and enhancing transparency.

Furthermore, the expanding approval of cryptocurrencies in mainstream money and commerce further strengthens their value suggestion. Several companies currently approve copyright settlements, paving the means for broader fostering.

Last but not least, the technical advancement underlying cryptocurrencies, such as blockchain, offers chances for investment in arising markets, consisting of decentralized financing (DeFi) and non-fungible symbols (NFTs), enhancing the investment landscape.

Significant Threats to Consider

One more important threat is regulatory unpredictability. Federal governments around the globe are still formulating plans relating to cryptocurrencies, and adjustments in regulations can drastically affect market dynamics - order cryptocurrencies. An undesirable regulatory environment can limit trading or even bring about the banning of certain cryptocurrencies

Security dangers likewise present a significant risk. Unlike conventional monetary systems, cryptocurrencies are susceptible to hacking and fraud. Financier losses can happen if exchanges are hacked or if personal keys are endangered.

Lastly, the absence of customer defenses in the copyright space can leave financiers at risk - order cryptocurrencies. With minimal recourse in case of scams or theft, people might discover it testing to recover lost funds

In light of these threats, comprehensive research and threat assessment are vital before taking part in copyright financial investments.

Strategies for Effective Investing

Establishing a robust method is important for navigating the complexities of copyright investment. Capitalists need to begin by conducting complete research to comprehend the underlying technologies and market characteristics of various cryptocurrencies. This includes remaining notified about patterns, regulative developments, and market view, which can considerably influence possession performance.

Diversification is an additional key technique. By spreading investments across multiple cryptocurrencies, financiers can mitigate risks related to volatility in any type of solitary asset. A healthy profile can supply a barrier versus market variations while boosting the potential for returns.

Establishing clear investment goals is crucial great site - order cryptocurrencies. Whether intending for short-term gains or long-term wealth build-up, specifying particular goals aids in making informed decisions. Executing stop-loss orders can also safeguard financial investments from substantial slumps, permitting a self-displined leave approach

Last but not least, continuous tracking and review of the financial investment method is vital. The copyright landscape is dynamic, and consistently assessing efficiency versus market conditions makes certain that investors remain agile and responsive. By sticking to these approaches, financiers can improve their chances of success in the ever-evolving world of copyright.

Future Trends in copyright

As investors refine their techniques, recognizing future patterns in copyright comes to be significantly essential. The landscape of electronic money is progressing quickly, affected Continue by technological improvements, governing growths, and shifting market dynamics.

Another emerging pattern is the expanding institutional passion in cryptocurrencies. As companies and financial establishments take on electronic money, mainstream acceptance is likely to enhance, possibly causing better rate security and liquidity. Furthermore, the assimilation of blockchain technology into different industries mean a future where cryptocurrencies act as a foundation for deals throughout fields.

Advancements in scalability and energy-efficient agreement mechanisms will certainly attend to concerns bordering deal rate and environmental influence, making cryptocurrencies much more sensible for everyday use. Comprehending these patterns will be critical for financiers looking to navigate the intricacies of the copyright market efficiently.

Conclusion

Report this page